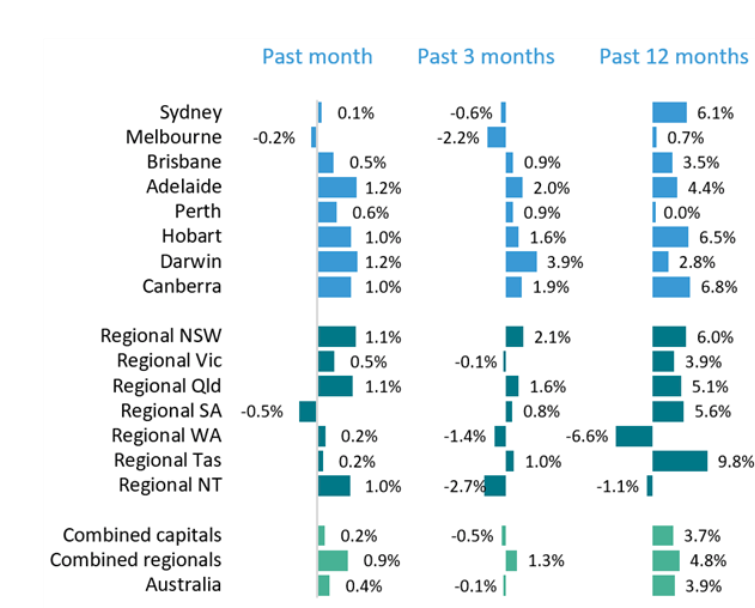

Regional property markets have picked up significantly over the past 12 months, even outperforming larger capital cities.

Why Is This The Case?

Improved market conditions and government incentives recently introduced have buoyed consumer confidence, luring buyers back into the market.

Consumer confidence has made a remarkable rebound, bolstered by the federal budget announcement of tax relief and large scale spending in infrastructure that supports job growth. Read more about consumer confidence.

The successful health response in containing the COVID-19 pandemic has seen many parts of the country slowly open up again, leading to increased optimism and improvement in consumer spending.

Some further influences that have been driving recent growth trends include:

Low-interest rates

The easing of COVID-19 restrictions

A change in housing preferences largely attributable to the rise in work from home flexibility born from COVID-19

Strong buyer demand has absorbed rapidly rising new supply. With fewer investors and foreign interest, first-home buyers are taking advantage of the reduced competition, government incentives, and low mortgage rates.

Change In Dwelling Values.

Regional house prices are growing at a faster rate than city homes, driven by increasing demand from buyers who are now able to work remotely or with fewer “in office” days making the “tree change” and “sea change” areas that are located within closer proximity to the larger cities more appealing.

This view is supported by recent figures released by leading research house CoreLogic Australia's Head of Research, Tim Lawless:

According to Lawless:

“The past two months have reversed the previous mild falls across the combined regional areas. In the seven months since March, regional dwelling values are up 1.7% while values across the combined capitals index have fallen by 2.3%.”

Lawless also mentions that the newfound popularity of working from home is only one factor helping to support regional prices. More affordable price points, lower densities and lifestyle factors are also under-pinning the relative strength across many regional areas of the country.

Many people appear to have chosen to abandon inner-city areas for outer suburbs and the regions as they came to appreciate the value of space at home during COVID-19 restrictions.

Employers are also expected to continue to allow many of their employees to work from home even after the pandemic is over, fuelling additional regional property demand.

Key Takeaways.

While we do not expect prices in capital cities to decline over the medium to longer-term, the opportunity in well-selected regional markets with strong underlying fundamental drivers is a smart proposition.

To stay up-to-date on all things property investment make sure you join our Property Market Pulse Newsletter here.

Bradley Wearne - General Manager & Head of Research at Meridian Australia

P: (02) 9939 3249

References

[1] CoreLogic

Comments