THE IMPORTANCE OF YIELD IN PROPERTY INVESTMENT

- Meridian Australia

- Mar 15, 2022

- 2 min read

A real estate yield is a measurement of future income on an investment. It is calculated annually as a percentage, based on the asset's cost or market value and has nothing to do with capital gain.

In the residential property space, you would want to achieve a 5% yield or more. In other words, if you purchased a $500,000 investment and were receiving $25,000 a year in rent, you are achieving a 5% yield, i.e. $25,000 is 5% of $500,000.

Therefore, rental yield measures the profit you generate each year from your investments as a percentage of its value.

Investors use their rental yield to evaluate the income they profit from their investments and to compare properties. A high rental yield equates to a greater cash flow.

The importance of getting a decent yield makes it far easier to hold the property through all circumstances including interest rate rises, vacancies, and land tax issues.

Should you just rely on yield?

When making your decision to invest in a property, do not rely on yield alone. High-yielding properties that don’t hold the other macro fundamentals will turn your high yield into a whole hill of beans.

As a rule of thumb, investing in a suburb that covers all macro and micro fundamentals, not just its yield, is imperative. One must invest in a suburb that has the Australian average of 70% owner-occupiers and 30% renters to establish a better yield and far less vacancy.

The COVID-19 pandemic has proven how some of the most desirable suburbs in Australia, the inner-city suburbs, are suffering in yield and vacancy as there are too few owner-occupiers and hence too many renters working in all the sectors of industries that have been severely hit such as hospitality and live music venues, student and backpacker accomodation.

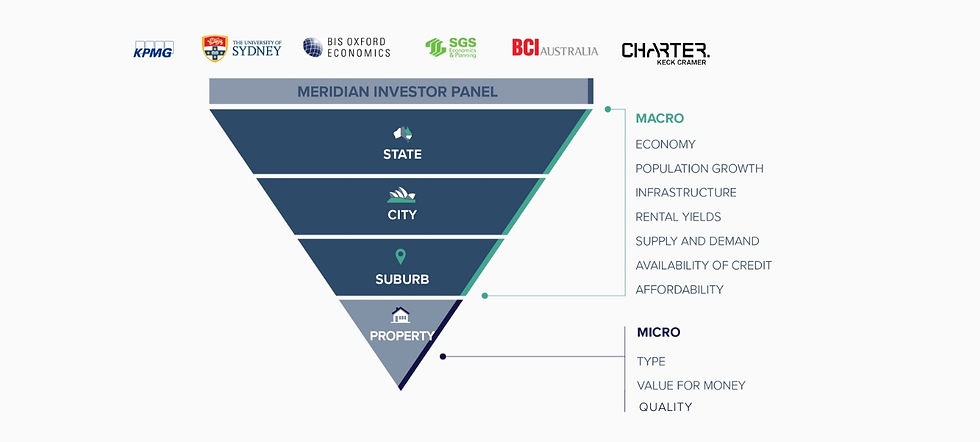

Remember, yield is one of many factors to look at prior to assessing the suitability of any given investment property. Some of the other fundamentals to factor into the mix are outlined in the Meridian Australia Research Model below.

-----

Next Steps

Looking to get the property investment conversation started?

Or, just looking to stay in the loop?

Warren Jacobs - National Business Development Manager at Meridian Australia

P: (02) 9939 3249

Disclaimer: When considering purchasing a property, it's always prudent to seek the advice of an appropriately qualified professional to determine which strategy is most appropriate for your circumstance.

Comments